Profile

In 9 individual projects, the research group "Financial Markets and Frictions - An Intermediary Asset Pricing Approach" wants to sound out whether we can understand the big picture of heavily fluctuating prices and risk premia over time and across assets by a shift in paradigm: From the standard household perspective towards an intermediate perspective.

Who

The research group is a cooperation of finance researchers from Karlsruhe, Frankfurt/Main, Tübingen, Stuttgart, Münster, and Vienna. The spokesperson of the research unit is Marliese Uhrig-Homburg. She is Professor of Finance at KIT and Managing Director of the Institute of Finance, Banking and Insurance (FBV). The deputy spokesperson of the research unit is Christian Schlag, Professor of Finance at Goethe University Frankfurt.

What

Understanding the structure and dynamics of risk premia is at the core of asset pricing. There is substantial variation of risk premia over time and across assets. One promising path to studying the variability in premia is to look at asset prices through the lens of frictions in financial intermediation. According to recent intermediary asset pricing models, such frictions are key to understanding asset prices and risk premia. The basic story works as follows: Direct investing is costly, so households give their money to intermediaries. Due to contracting frictions, regulatory constraints, or market entry barriers, intermediaries do not invest in full accordance with the preferences of households. As a result, intermediation frictions enter the pricing expressions for intermediated assets and impose a wedge between the private valuation of assets from the household side and the market price emerging from the intermediary perspective..

Clearly, a significant amount of investment is intermediated, and there is ample evidence that intermediation frictions cause price movements in various markets. The vast amount of this literature is motivated by crises phenomena. However, the relevance of intermediary frictions is not limited to crisis periods. So there is a definite need for a better understanding of the general role of intermediaries with respect to asset pricing. As a Research Unit, we are guided by the theory on intermediary asset pricing. We want to sound out whether we can understand the big picture of heavily fluctuating prices and premia over time and across assets by a shift in paradigm: From the standard household perspective - with the notion that the household is always marginal - towards an intermediary perspective. If frictions in financial intermediation are important, they may allow prices to fluctuate more widely than suggested by standard models. Thus, instead of contributing to the vast literature that has produced a whole ''zoo'' of factors, we seek to identify key frictions and to separate their effects from classical risk factors.

How

We aim to provide empirical strategies, models, and methods, use them to reach new insights about the formation of asset prices, and shape future research in the field.

Specifically, we aim to understand,

- what the main frictions are that affect prices and risk premia,

- when they are relevant

- and what role intermediaries play in this context.

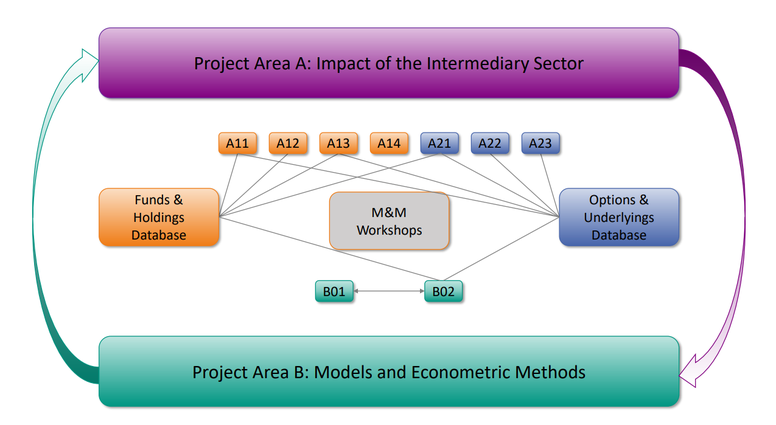

We consequently organize our RU in two main project areas: Project area A seeks to provide novel evidence on the impact of intermediaries for asset pricing and project area B aims to advance intermediary asset pricing models and corresponding econometric strategies.