Models & Methods Workshop

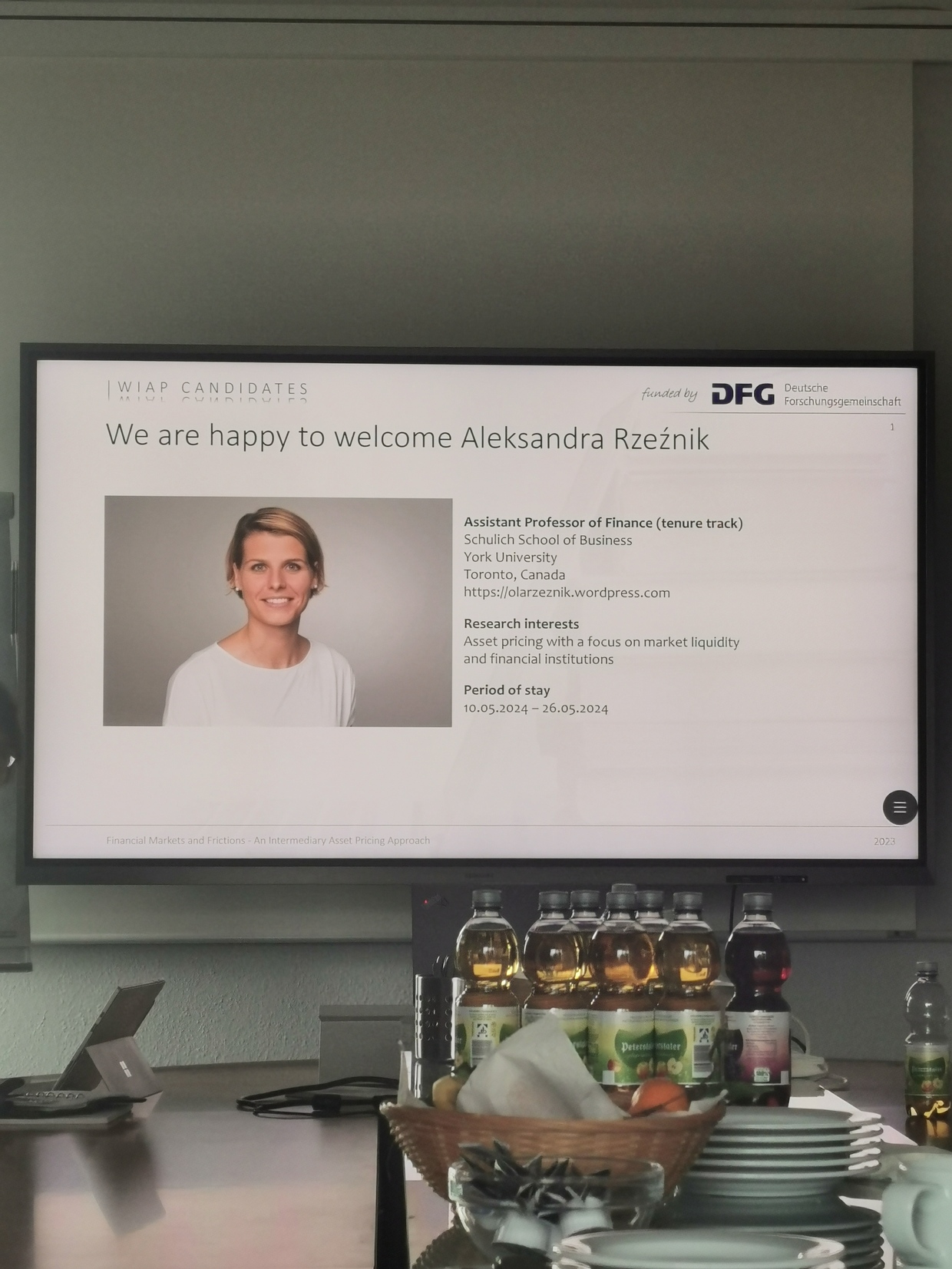

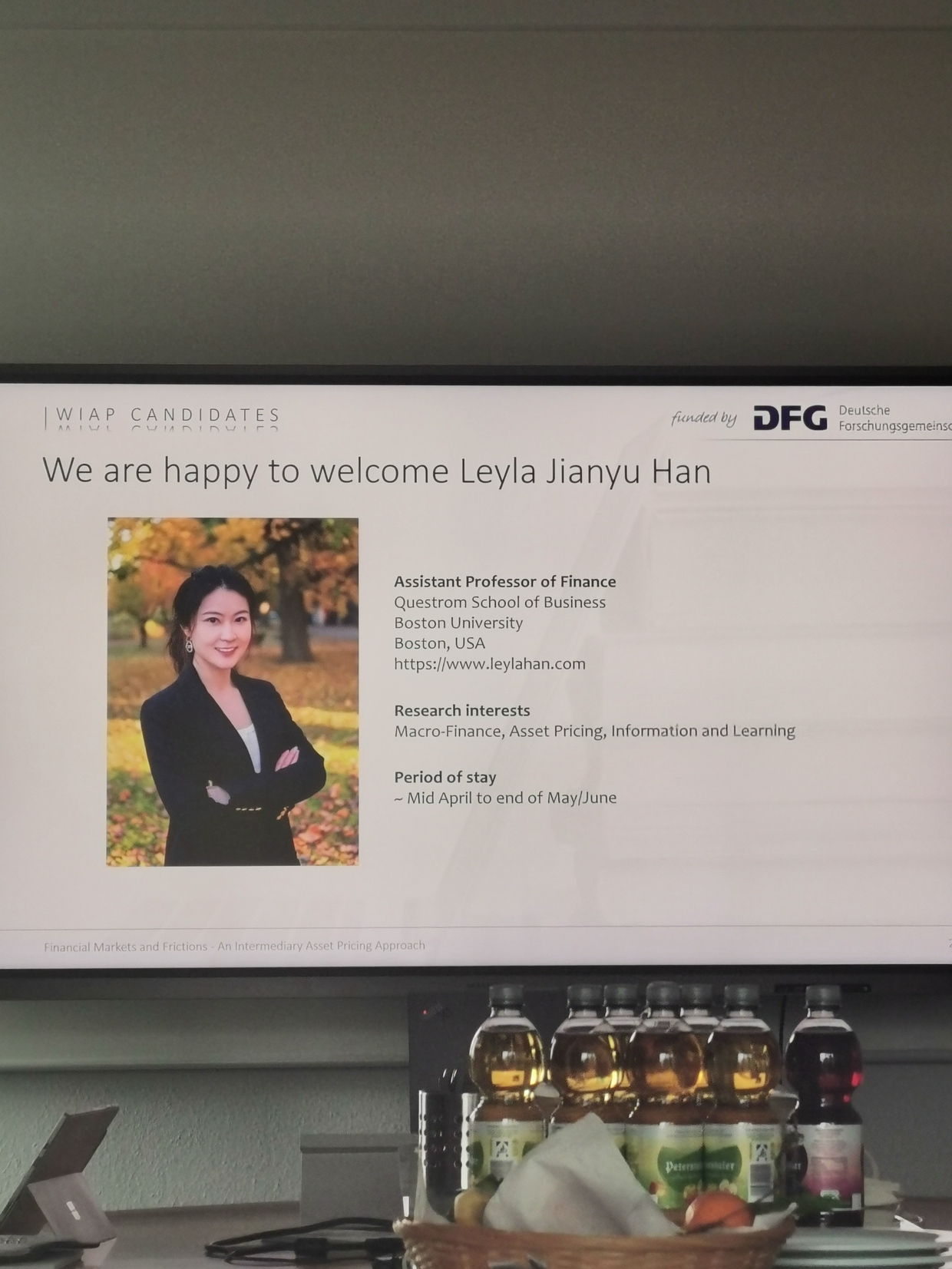

These workshops focus on the development and refinement of models and empirical methods relevant to intermediary asset pricing. They provide a dedicated space for researchers to discuss methodological challenges and coordinate their approaches. By fostering methodological innovation, the workshops enhance the quality and consistency of research outputs. They also help integrate theoretical and empirical advancements within the RU.

M&M Workshop 2025

On February 13–14, 2025, the Research Unit held its annual Methods & Modelling Workshop at KIT in Karlsruhe. The workshop provided a valuable forum for deepening methodological foundations and discussing ongoing research across subprojects. You can find the program here.

The first day focused on demand-based asset pricing, with presentations by Patrick Brock and Rüdiger Weber, followed by a session from A12 on the distinct risk profile of corporate bond ETFs, presented by Johannes Dinger. The day concluded with a project leader meeting and a joint dinner.

The second day featured contributions from B01, where Leonie Wieneke explored heterogeneous investors in a production economy. The event closed with a farewell session, fostering productive discussions and future collaboration within the RU.

M&M Workshop 2024

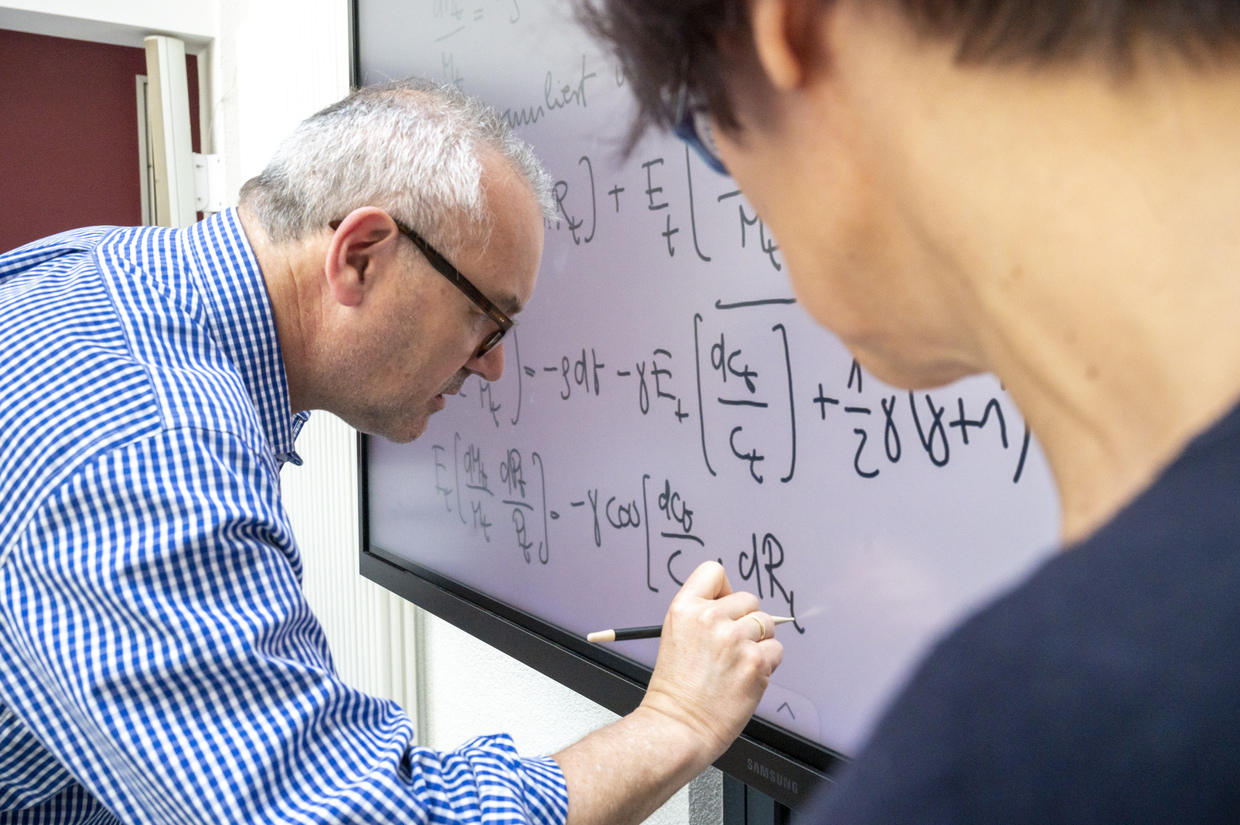

On May 13, 2022, the DFG Research Unit FOR 5230 held its Methods & Modelling Workshop at KIT, in Karlsruhe. The workshop focused on foundational and advanced modeling techniques relevant to intermediary asset pricing. Participants explored theoretical frameworks, numerical methods, and model applications, aiming to refine analytical tools used in financial market research. The event provided an opportunity for in-depth discussions on model structures and methodological advancements. You can find the program here.

The workshop began with a session on the baseline model of He & Krishnamurthy (2013), setting the stage for later discussions. The afternoon sessions focused on numerical methods, Epstein-Zin utility functions, and long-run risk models, providing insights into their implementation and relevance for intermediary asset pricing. The final session explored production-based asset pricing models. The workshop fostered an engaging exchange of ideas, strengthening methodological expertise within the research group.

M&M Workshop 2023

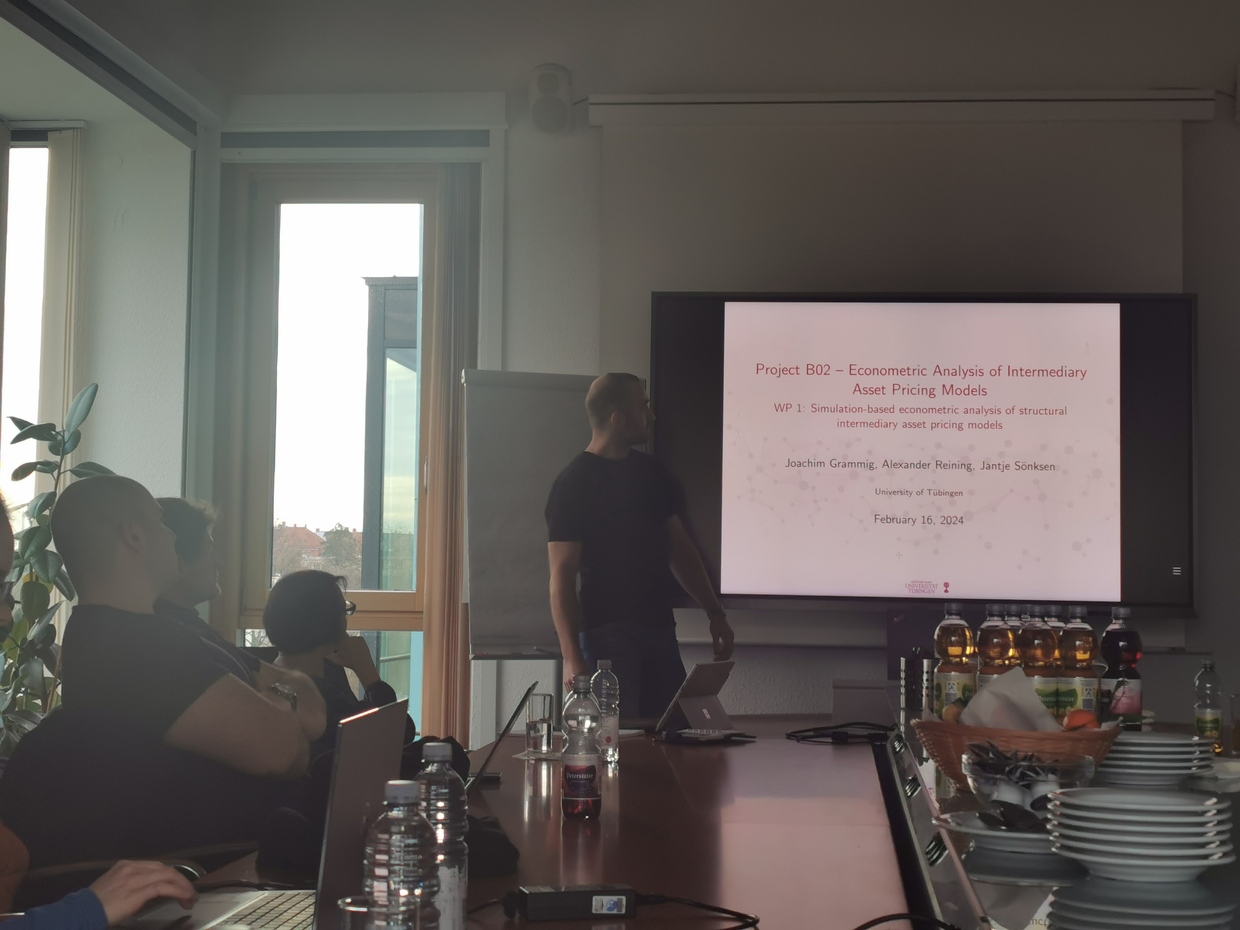

On February 23–24, 2023, the Research Unit hosted its Methods & Modelling Workshop at KIT, in Karlsruhe. The event focused on the theoretical models used by each of the subprojects within the research group. Several projects presented its modeling approaches and methodologies in the context of intermediary asset pricing, facilitating valuable discussions among participants. This workshop provided an opportunity to refine models and approaches, contributing to the overall progress of the research unit. You can find the program here.

Throughout the two days, A14, A23, B01, A12, and B02 presented their theoretical models, focusing on different aspects of intermediary asset pricing. The presentations fostered constructive discussions, with participants providing valuable feedback on the models and suggesting new avenues for future research. The workshop also featured informal discussions over meals, including a dinner at Kaisergarten, which enhanced the exchange of ideas among the researchers. The event concluded with a farewell lunch, leaving participants with fresh insights and a strengthened sense of collaboration within the group.

M&M Workshop 2022

On May 13, 2022, the DFG Research Unit FOR 5230 held its Methods & Modelling Workshop at KIT, in Karlsruhe. The workshop focused on foundational and advanced modeling techniques relevant to intermediary asset pricing. Participants explored theoretical frameworks, numerical methods, and model applications, aiming to refine analytical tools used in financial market research. The event provided an opportunity for in-depth discussions on model structures and methodological advancements. You can find the program here.

The workshop began with a session on the baseline model of He & Krishnamurthy (2013), setting the stage for later discussions. The afternoon sessions focused on numerical methods, Epstein-Zin utility functions, and long-run risk models, providing insights into their implementation and relevance for intermediary asset pricing. The final session explored production-based asset pricing models. The workshop fostered an engaging exchange of ideas, strengthening methodological expertise within the research group.

_rdax_1240x930s.jpg)

_rdax_1240x930s.jpg)

_rdax_1240x930s.jpg)

_rdax_1240x930s.jpg)

_rdax_1240x825s.jpg)

_rdax_1240x825s.jpg)

_rdax_1240x826s.jpg)

_rdax_1240x825s.jpg)