Internal Seminar

The internal seminar brings together all members of the research unit (RU) to present and discuss their ongoing projects. It serves as a platform for sharing insights, receiving feedback, and fostering collaboration across different research areas. By facilitating exchange among researchers, the seminar strengthens the overall coherence of the RU’s work. Participants can refine their methodologies and explore potential synergies. The event ensures that all projects align with the broader objectives of the research unit.

Internal Seminar 2025

On October 23 - 24, 2025, the research group met for its annual internal seminar at the Bildungshaus St. Bernhard in Rastatt. At the event, the members of the research group presented and discussed their research work. The internal seminar covered a wide range of topics, including intermediation in the corporate bond market, measurement of option liquidity, and the role of heterogeneous financial intermediaries in asset pricing theory. Individual group meetings strengthened interdisciplinary collaboration and shaped future research directions. The detailed schedule is available here .

The seminar started with Marius Schmidt's (A12) recent presentation "Intermediation Dynamics in Corporate Bond Market". After lunch, Dr. Marcel Müller presented the current status of the project "Same Same But Different: The Risk Profile of Corporate Bond ETFs" (A12) and Alexander Götz (A22) his project "Measuring Option Liquidity". The first day ended with a short report on sub-project B01 by Alexander Reining and individual discussions.

On the second day, Fanchen Meng (A23) gave a presentation on the status of the project "How Option Traders Take Sides on Return Predictability" and Leonie Wieneke (B01) on the project "Intermediary Asset Pricing with Heterogeneous Intermediaries". All presentations were discussed by project leaders.

Internal Seminar 2024

On September 16–17, 2024, the Research Unit held its annual Internal Seminar at WU Wien in Vienna. The event provided an opportunity for researchers to present and discuss their latest work on intermediary asset pricing. Sessions covered a range of topics, including the role of traders in fund management, intermediary risk, monetary policy, and market frictions. The seminar also featured group meetings and discussions, fostering collaboration among participants. The detailed schedule is available here.

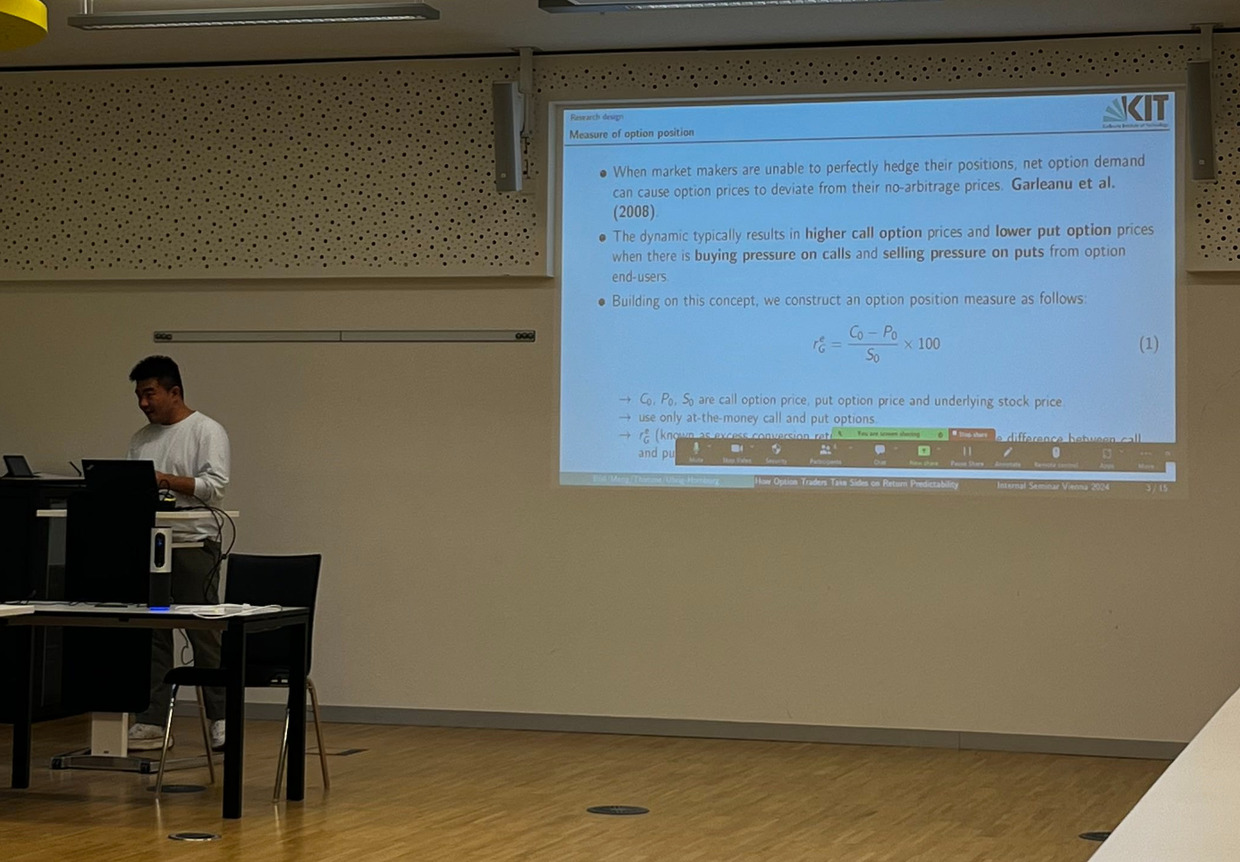

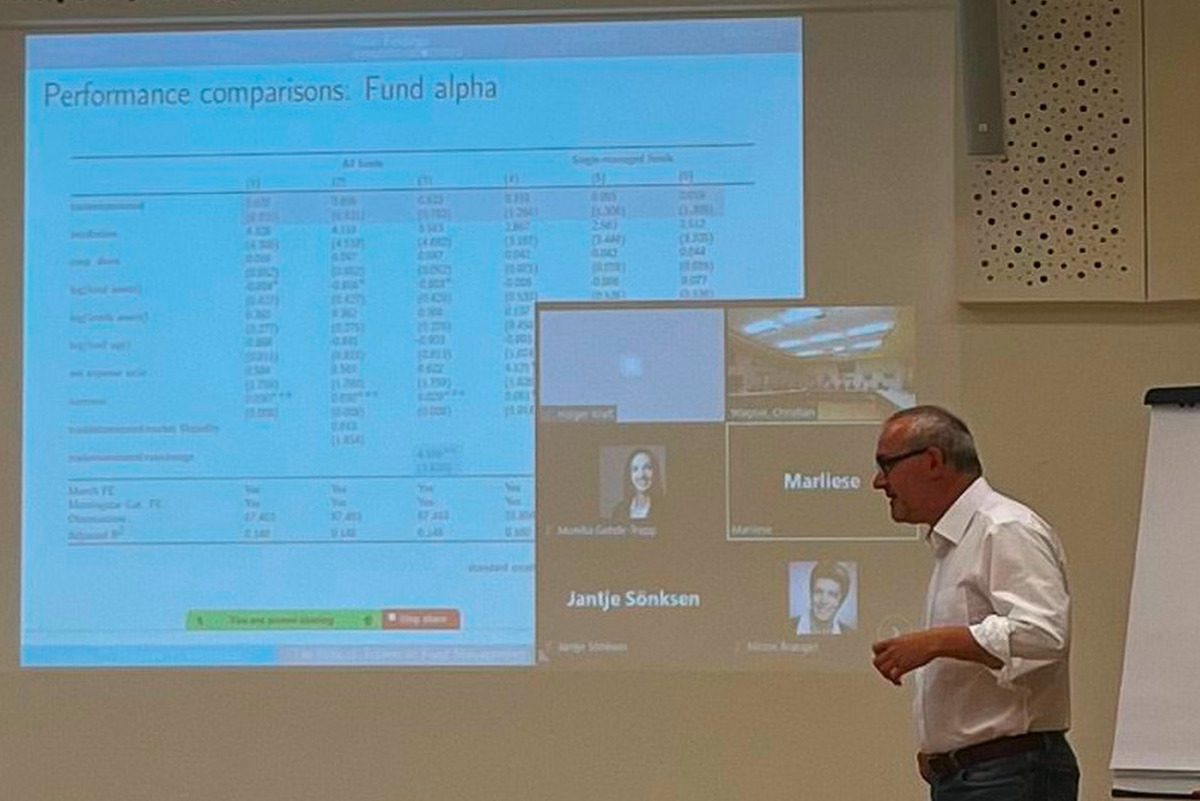

The seminar began with Franziska Weishaupt (A12) presenting "Once a Trader, Always a Trader: The Role of Traders in Fund Management," followed by short reports from A11, A13, and A14. In the afternoon, Matthias Reiner (A21) discussed "Intermediary Risk and Monetary Policy," and Caroline Grauer & Jan Harren (A22) presented "Measuring Option Order Imbalance." The first day concluded with Fanchen Meng (A23) delivering a talk on "How Option Traders Take Sides on Return Predictability."

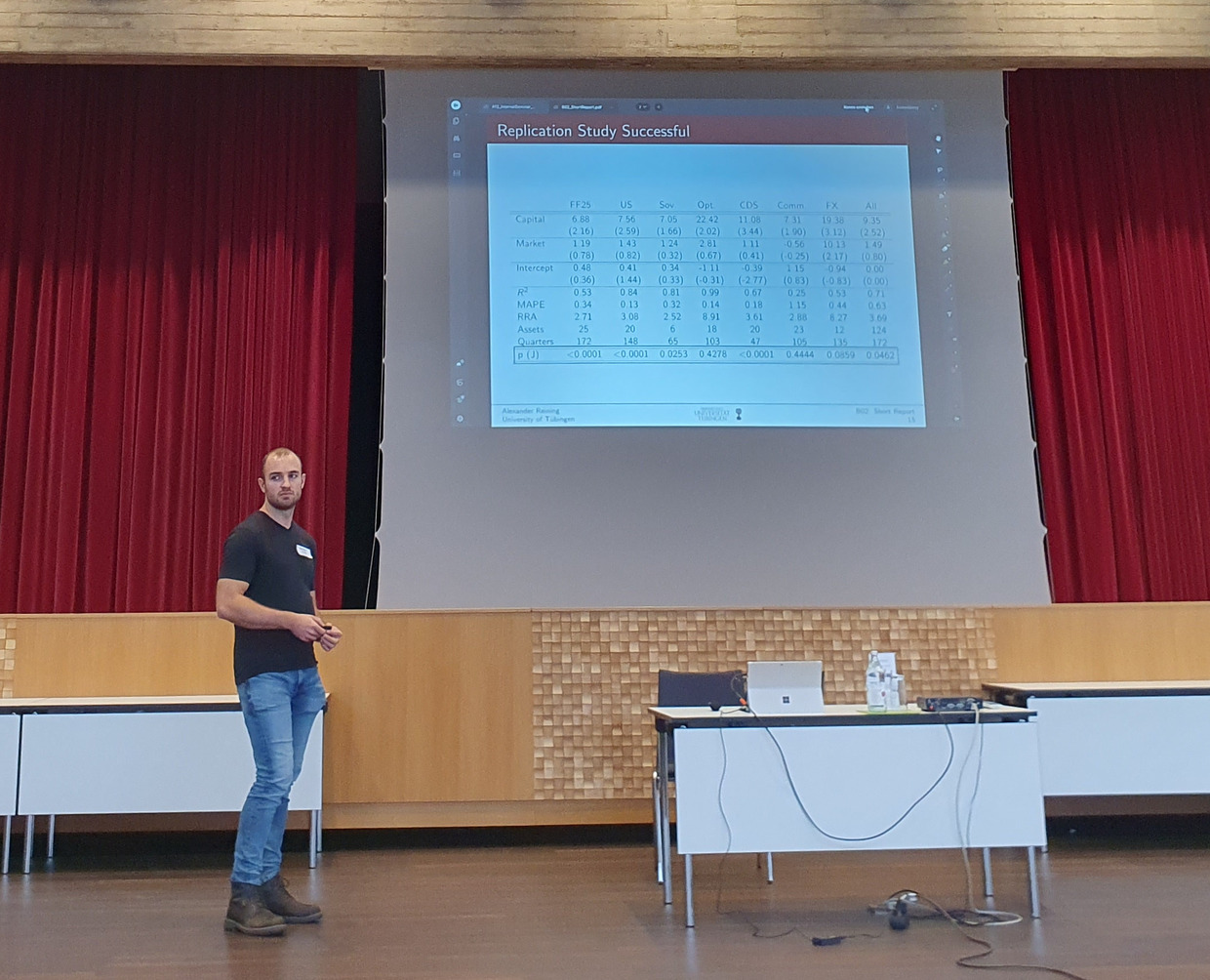

The second day started with Leonie Wieneke (B01) presenting "Intermediary Asset Pricing with Heterogeneous Intermediaries," with a discussion by Holger Kraft. Later, Alexander Reining (B02) introduced a simulation-based approach in his talk "Intermediary Asset Pricing with Heterogeneous Agents." The seminar wrapped up with individual group meetings, reinforcing interdisciplinary collaboration and shaping future research directions.

Internal Seminar 2023

On November 16–17, 2023, the Research Unit held its annual Internal Seminar at the Bildungshaus St. Bernhard in Rastatt. The detailed schedule is available here.

The seminar began with a presentation from A13, exploring the impact of ETFs on market tail risk. B01 followed with a discussion on flexible theoretical models of intermediary asset pricing, accompanied by a short report on their progress. Later, A12 presented findings on fragmented intermediation and bond risk premia, while A23 discussed asset pricing anomalies.

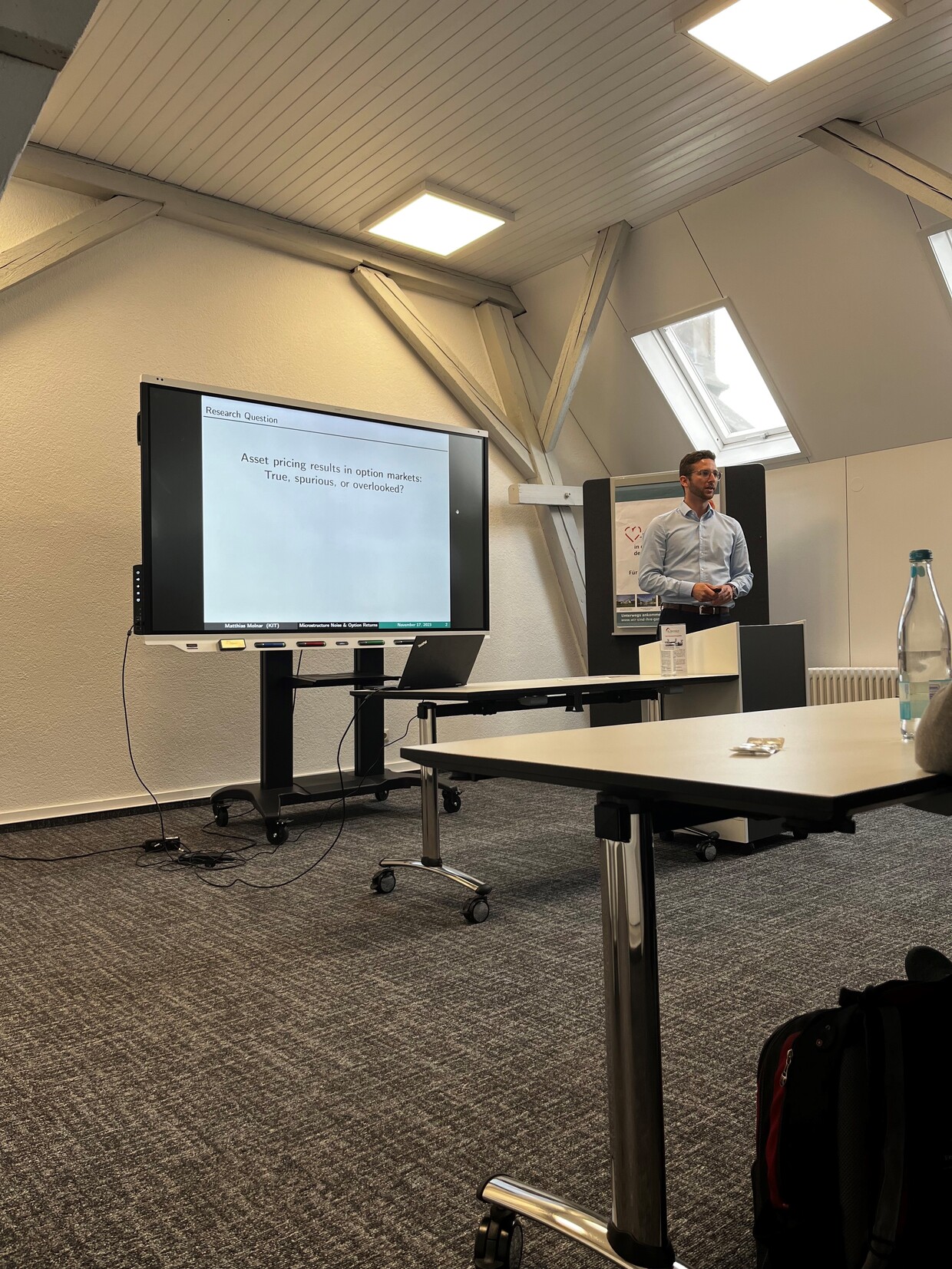

On the second day, B02 and A21 opened the sessions with insights into econometric approaches and monetary policy’s role in asset pricing. A14 presented a paper on the effects of passive investing on asset prices, followed by A22, which examined intermediary frictions and dealer positions in financial markets. The seminar concluded with engaging discussions, strengthening the collaborative research efforts within the group.

Internal Seminar 2022

On November 17–18, 2022, our first Internal Seminar took place at the Bildungshaus St. Bernhard in Rastatt. The seminar provided a platform for members of the Research Unit to present and discuss their ongoing research on intermediary asset pricing. The event featured a series of presentations and discussions, fostering collaboration and knowledge exchange among participants. The detailed schedule is available here.

The seminar commenced with short reports from subprojects A11 and B01, where researchers provided updates on their investigations into investment managers' roles in asset pricing and the development of flexible theoretical models, respectively. Following lunch, subproject A13 presented insights into the impact of exchange-traded funds on tail risk, highlighting preliminary findings and methodologies. A short report from A14 shed light on the effects of passive investing on asset prices. The day concluded with a presentation from A21, discussing the interplay between monetary policy, financial intermediaries, and asset prices.

The second day began with a short report from A22, followed by a detailed presentation that delved into intermediary frictions, dealer positions, and their influence on option pricing. Subproject A23 offered a presentation on characterizing asset pricing anomalies, proposing new frameworks for understanding persistent market irregularities. The seminar concluded with short reports from A12 and B02, discussing fragmented intermediation in bond markets and econometric analyses of intermediary asset pricing models, respectively. Throughout the seminar, each subproject outlined its current research status and future plans, engaging in constructive discussions that provided valuable feedback and fostered interdisciplinary collaboration. The event strengthened the research unit's cohesion and advanced our collective understanding of financial markets and frictions.